Have you ever wondered how automation is transforming the financial world? From processing transactions at lightning speed to reducing human errors, automation is the driving force behind a more efficient and innovative finance industry.

As the financial sector faces increasing pressure to enhance customer experience, comply with regulations, and cut costs, automation offers a game-changing solution. Leveraging technologies like artificial intelligence (AI), robotic process automation (RPA), and machine learning, the industry is witnessing unprecedented growth and innovation.

This blog delves into the role of automation in the finance industry, showcasing its impact on operations, customer service, compliance, and risk management. We’ll explore real-world examples, benefits, and challenges while offering actionable insights for enterprises aiming to adopt automation effectively.

By the end of this article, you’ll understand why automation isn’t just a trend but a necessity for financial institutions to thrive in the digital age.

The Role of Automation in Financial Operations

Automation has reshaped the core operations of financial institutions by introducing efficiency and precision. Traditional manual processes, such as invoice processing, payroll management, and account reconciliations, are now handled by automated systems.

For example, Robotic Process Automation (RPA) enables financial organizations to automate repetitive tasks like data entry and reporting, reducing human error while saving time. Studies show that RPA can reduce operational costs by up to 30%.

Moreover, automation improves scalability. During peak periods, such as tax season, automated systems can handle large volumes of transactions without delays, ensuring seamless customer service. Financial institutions like JP Morgan have adopted automation to process loan agreements, a task that previously required 360,000 hours annually.

However, challenges such as integrating legacy systems and ensuring data security remain. Financial enterprises must address these concerns to maximize the benefits of automation.

Enhancing Customer Experience with Automation

Today’s customers demand personalized, fast, and seamless financial services. Automation enables financial institutions to meet these expectations by utilizing AI-powered chatbots, mobile banking apps, and predictive analytics.

Chatbots, for instance, provide 24/7 customer support, answering queries and assisting with transactions in real time. A notable example is Bank of America’s “Erica,” which uses AI to deliver personalized insights and financial advice to users.

Furthermore, automation enables predictive analytics, allowing banks to analyze customer behavior and offer tailored financial products. According to McKinsey, organizations that leverage data-driven personalization see a 20–30% increase in customer satisfaction and sales.

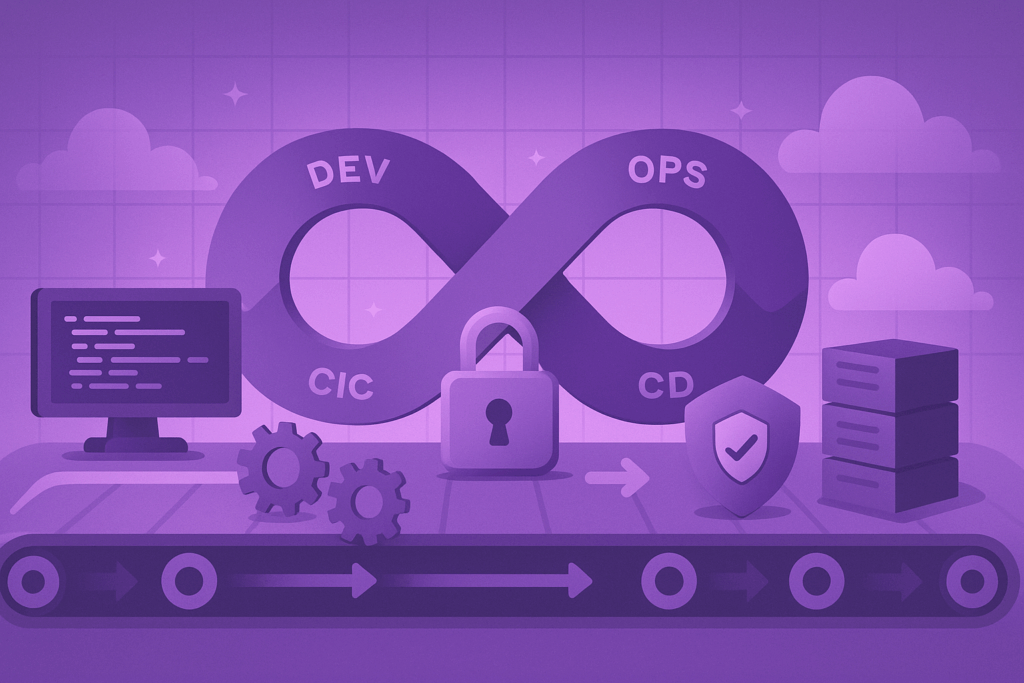

Automation and Regulatory Compliance

Compliance with regulations is a critical aspect of the finance industry. Automation simplifies this process by ensuring accurate and timely adherence to legal requirements.

Regulatory Technology (RegTech), a subset of automation, helps institutions monitor transactions, detect anomalies, and generate compliance reports. For example, automated Anti-Money Laundering (AML) systems can identify suspicious activities and flag them for review within seconds.

Moreover, automation reduces the risk of non-compliance fines. In 2020, financial institutions paid over $10 billion in penalties due to compliance failures. Automated solutions can mitigate such risks by maintaining real-time updates on regulatory changes and ensuring adherence.

However, to ensure successful implementation, organizations must collaborate with experienced partners to integrate RegTech solutions seamlessly.

Risk Management Through Automation

Automation plays a pivotal role in identifying and managing risks in the finance industry. AI-powered systems analyze vast datasets to detect patterns and predict potential threats, helping organizations make informed decisions.

Fraud detection is a prime example. Automated systems monitor transactions in real time, identifying irregularities and preventing fraud before it occurs. Visa’s AI-driven fraud prevention system reportedly saves billions of dollars annually by detecting fraudulent transactions with 90% accuracy.

Challenges and Future of Automation in Finance

Despite its numerous benefits, implementing automation in the finance industry comes with challenges. Legacy systems, data privacy concerns, and the high cost of advanced technologies are significant barriers.

However, the future looks promising. Emerging trends such as hyperautomation, where multiple technologies work together seamlessly, are set to redefine financial processes. According to Gartner, hyperautomation could reduce costs by 25% while increasing operational efficiency.

Conclusion

The finance industry is at a crossroads, with automation serving as the catalyst for transformation. From streamlining operations to enhancing customer experience and ensuring compliance, automation has proven to be a game-changer.

However, the journey is not without challenges. Organizations must address barriers such as legacy systems and data privacy concerns to unlock automation’s full potential.

By embracing automation strategically, financial institutions can not only stay competitive but also drive innovation and growth in the digital era.