Introduction

Policy management is a cornerstone of the insurance industry, but manual processes can often lead to costly human errors. Automation is revolutionizing policy management by streamlining operations, enhancing accuracy, and reducing administrative burdens. In this blog, we’ll explore how automation reduces human errors and its impact on the insurance industry.

The Challenges of Manual Policy Management

Traditional policy management involves multiple steps, including data entry, updates, renewals, and claims processing. Common issues include:

- Data Entry Mistakes: Manual inputs can lead to errors in policyholder details.

- Missed Deadlines: Oversights in renewal schedules or regulatory compliance.

- Inconsistent Processes: Varying practices across departments or individuals.

Such errors can result in customer dissatisfaction, regulatory fines, and revenue losses.

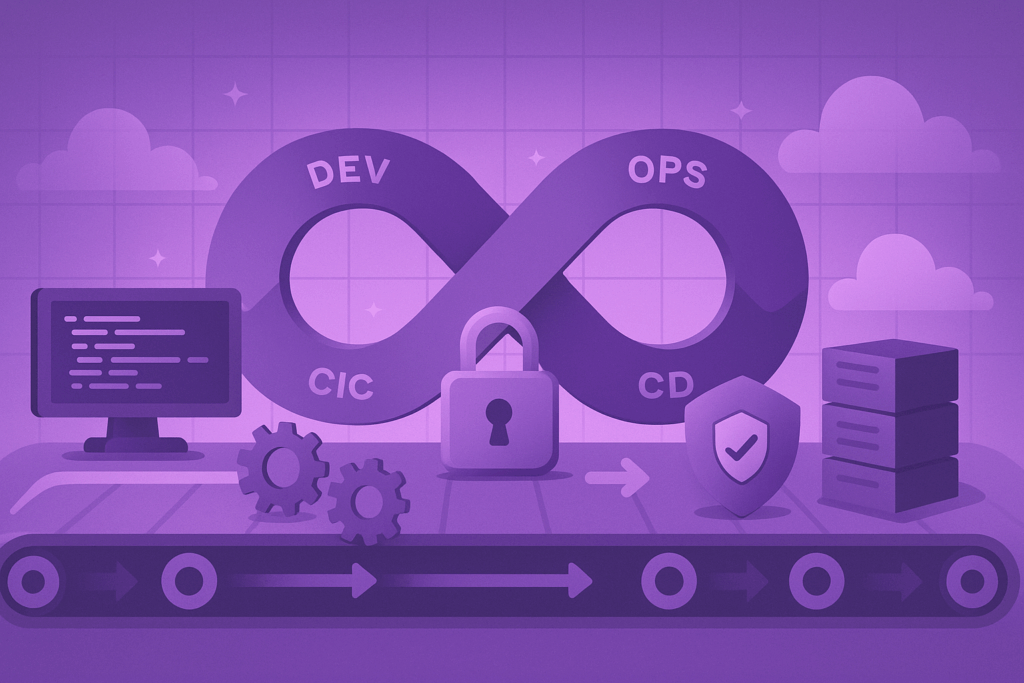

How Automation Minimizes Human Errors

1. Eliminating Data Entry Errors

Automated systems use AI and machine learning to validate and input data.

- Features:

- Optical character recognition (OCR) for document processing.

- Real-time data verification to ensure accuracy.

- Impact: Reduces the likelihood of typos, misentries, and duplicated information.

2. Streamlining Policy Renewals

Automation ensures policy renewals are timely and error-free.

- How It Works:

- Automated reminders for customers and agents.

- Smart systems that auto-renew policies based on predefined conditions.

- Outcome: Eliminates missed deadlines and keeps policies active without disruption.

3. Consistent Policy Updates

Automated workflows standardize how updates are made across the organization.

- Example: When regulatory changes occur, automation ensures updates are applied uniformly across all relevant policies.

- Result: Maintains compliance and reduces discrepancies.

4. Enhancing Claims Processing

Automation reduces errors in claim approvals and payouts.

- Features:

- AI-powered fraud detection to flag anomalies.

- Auto-calculation of payouts based on policy terms.

- Advantage: Faster and more accurate claims resolutions.

5. Improving Customer Communication

Automated communication tools ensure policyholders receive accurate and timely updates.

- Tools Used:

- Chatbots for 24/7 assistance.

- Automated emails and SMS for policy status and updates.

- Benefit: Reduces miscommunication and enhances customer trust.

The Benefits of Automation in Policy Management

- Accuracy: Minimizes manual errors through standardized processes.

- Efficiency: Reduces administrative time, allowing teams to focus on strategic tasks.

- Compliance: Ensures adherence to regulatory requirements.

- Customer Satisfaction: Enhances trust through error-free and timely interactions.

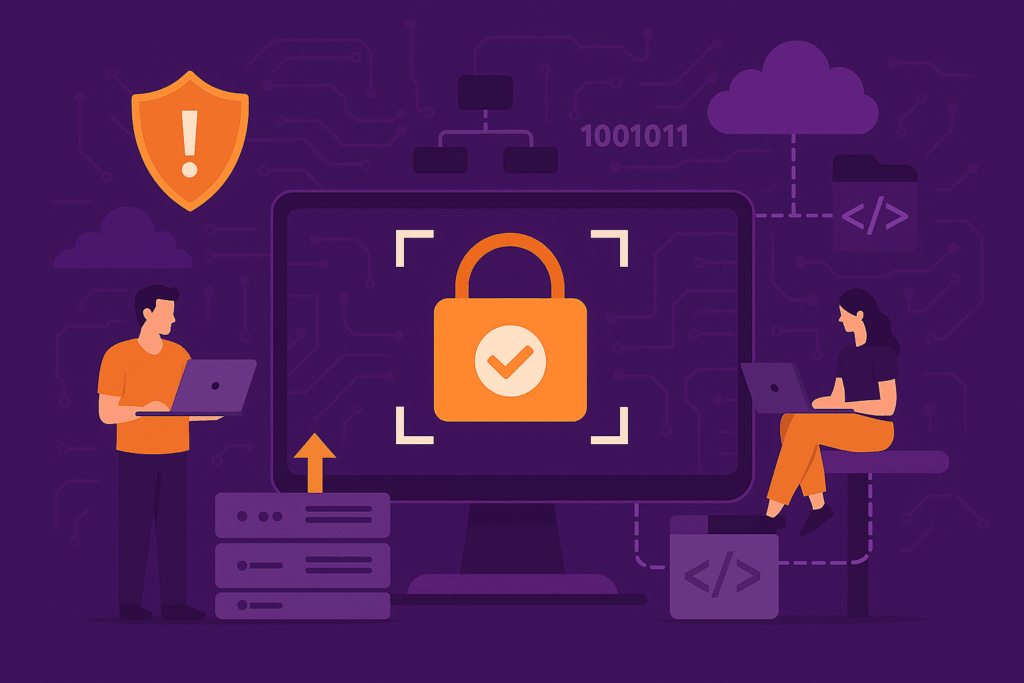

Challenges to Consider

While automation offers significant benefits, its implementation requires:

- Initial Investment: Upfront costs for software and training.

- System Integration: Ensuring compatibility with existing tools.

- Data Security: Protecting sensitive policyholder information.

Conclusion

Automation is a game-changer for policy management, offering unprecedented accuracy, efficiency, and customer satisfaction. By reducing human errors, insurers can focus on delivering exceptional service and staying competitive in a dynamic industry.

Let 247 Labs help you integrate automation into your policy management systems. Contact us today at 1-877-912-5560 or email [email protected] to streamline your operations and minimize errors.