Introduction

The insurance industry is being reshaped by the rise of insurtech startups. These innovative companies leverage cutting-edge technology to revolutionize traditional insurance processes, offering greater efficiency, personalized services, and improved customer experiences. In this blog, we’ll explore five key ways insurtech startups are transforming the industry.

1. Streamlining Claims Processing

Insurtech startups are automating claims processes using artificial intelligence (AI) and machine learning (ML).

- Benefits:

- Faster claim approvals.

- Reduced paperwork.

- Increased transparency for policyholders.

- Example: Some startups use AI-powered chatbots to guide customers through claims filing, ensuring a smooth experience.

2. Personalized Insurance Offerings

Insurtech companies utilize data analytics to offer tailored policies based on individual risk profiles.

- Key Features:

- Pay-as-you-go insurance for on-demand coverage.

- Usage-based insurance for car drivers or gig workers.

- Impact: Customers get better value and coverage suited to their unique needs.

3. Enhanced Risk Assessment with Predictive Analytics

Startups are using predictive analytics to redefine risk assessment.

- How It Works:

- Aggregating real-time and historical data to predict potential risks.

- Using IoT devices to monitor behaviors and adjust premiums accordingly.

- Outcome: Improved accuracy in risk profiling and pricing.

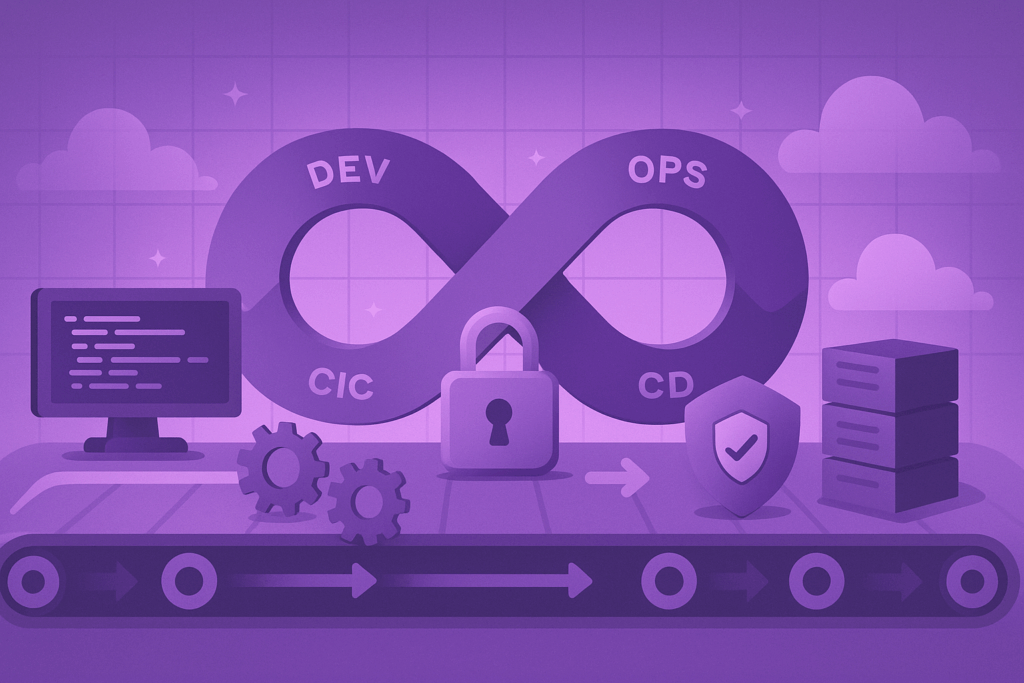

4. Blockchain for Transparent Transactions

Blockchain technology is being adopted by insurtech startups to enhance trust and security.

- Applications:

- Smart contracts for automatic claim payouts.

- Secure storage of sensitive customer information.

- Advantage: Increased trust between insurers and policyholders due to tamper-proof records.

5. Improving Customer Engagement

Innovative digital platforms and mobile apps are transforming how customers interact with insurers.

- Notable Features:

- 24/7 accessibility via apps.

- Interactive tools to educate users on policies and coverage.

- Result: Higher customer satisfaction and retention rates.

Why Insurtech Startups Are Gaining Traction

- Cost Savings: Automation reduces operational costs for insurers.

- Customer-Centric Approach: Focus on creating user-friendly solutions.

- Agility: Startups can quickly adapt to changing customer needs and market trends.

Conclusion

Insurtech startups are driving unprecedented change in the insurance industry. By harnessing the power of AI, blockchain, and predictive analytics, they are creating more efficient systems, personalized policies, and transparent operations.

Interested in leveraging technology to stay ahead in the insurance industry? Partner with 247 Labs for innovative tech solutions. Contact us today at 1-877-912-5560 or email [email protected] to learn more.